Use Cases and Limitations

This module examines how shared sequencer networks and atomic composability are being applied in real-world scenarios, with particular focus on decentralized finance (DeFi), cross‑rollup applications, and MEV markets. It also discusses the practical limitations and risks that remain unresolved, including technical, economic, and governance challenges.

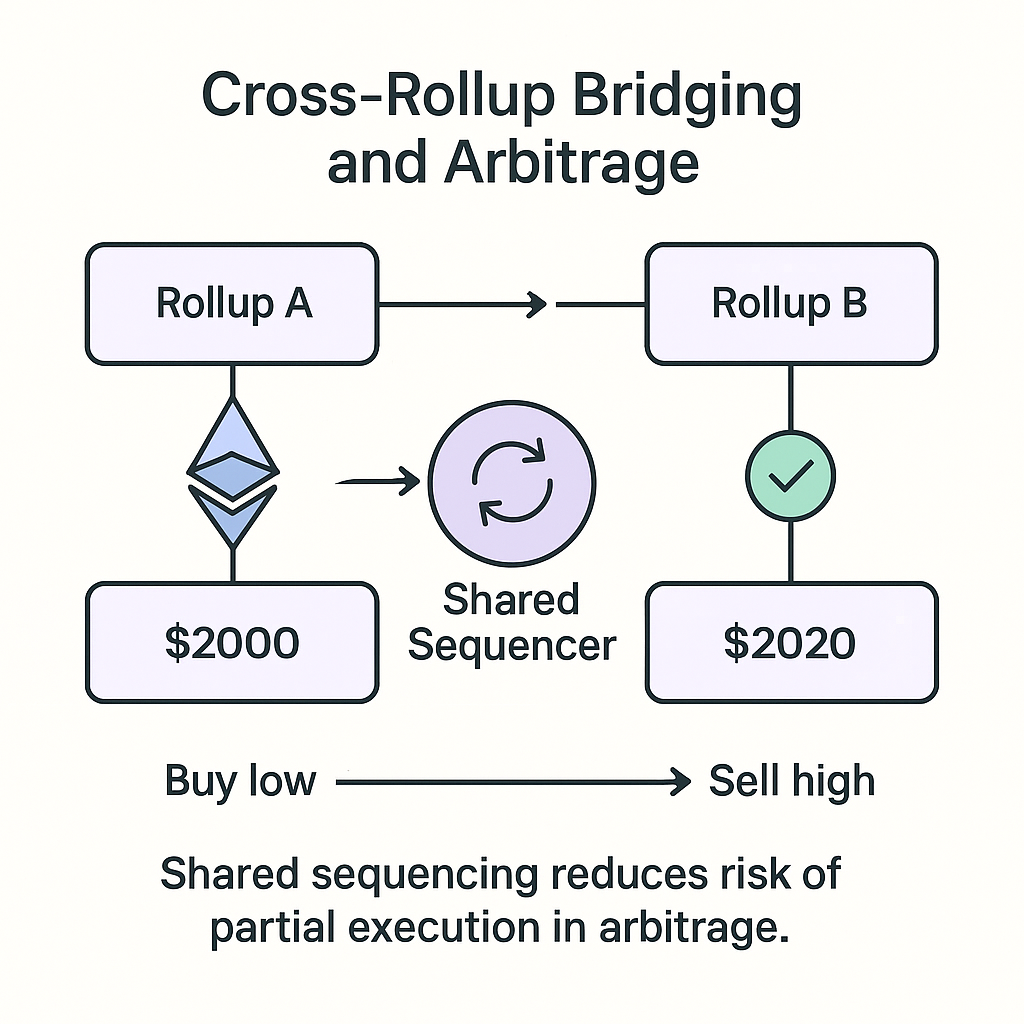

Cross-Rollup Bridging and Arbitrage

One of the most immediate use cases for shared sequencer networks is bridging between rollups. Traditional cross-rollup bridges rely on asynchronous message passing, which introduces latency and security risks. A user locking assets on one rollup must wait for finality before minting a representation on another, leading to delays ranging from minutes to hours. Shared sequencers address this by providing atomic inclusion, allowing the lock and mint operations to be ordered together in the same batch. This approach reduces bridging latency and mitigates the risk of partial execution, which is especially important for users moving liquidity across multiple rollups.

Arbitrage is another compelling application. Price discrepancies often arise between decentralized exchanges operating on different rollups. Without synchronized ordering, arbitrageurs face execution risk: by the time a transaction on one rollup finalizes, the price on another may have shifted. Shared sequencers allow cross-rollup arbitrage bundles to be included atomically, improving the efficiency of price discovery and reducing opportunities for predatory MEV. Early experiments with cross-domain arbitrage on Espresso’s testnets in 2024 demonstrated measurable improvements in slippage and execution reliability.

Multi-Rollup DeFi Protocols

DeFi protocols increasingly seek to operate across multiple rollups to capture diverse user bases and liquidity pools. Lending protocols, for instance, may maintain isolated markets on different rollups but desire unified risk management. Shared sequencers enable coordinated actions, such as rebalancing collateral or liquidating positions across rollups, without reliance on slow external bridges. Similarly, derivatives platforms can construct cross-rollup instruments that settle atomically, expanding the design space for complex financial products.

Composable yield strategies benefit significantly from atomic inclusion. For example, a user could stake assets on one rollup, borrow stablecoins on another, and deploy them in a yield farm on a third, all within a single coordinated sequence. Without shared sequencing, such strategies are fragmented and exposed to failure at each intermediate step. While most current implementations still lack full atomic execution, the reduction in inclusion risk is already a meaningful improvement for developers and traders.

MEV and Bundle Optimization

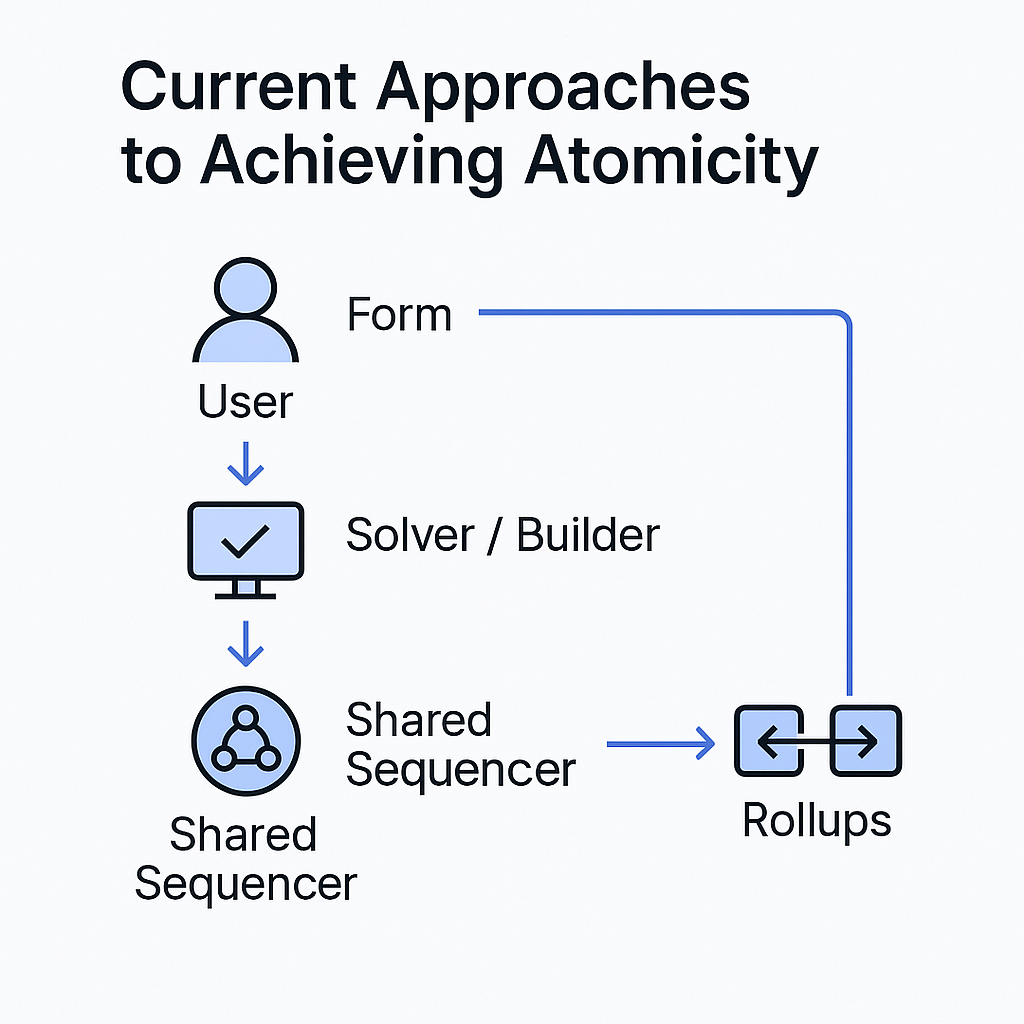

Maximal Extractable Value (MEV) arises when block producers or sequencers can reorder, include, or exclude transactions for profit. In a multi-rollup environment, MEV opportunities extend beyond single chains to cross-rollup arbitrage, liquidations, and sandwich attacks. Shared sequencers introduce both risks and opportunities in this context.

On one hand, centralized sequencers controlling multiple rollups could internalize cross-rollup MEV, creating opaque markets and potential value leakage from users. On the other hand, decentralized shared sequencer networks can implement open MEV auctions, where builders compete transparently to include cross-rollup bundles. Espresso Systems has piloted such sequencing auctions, inspired by Ethereum’s proposer‑builder separation (PBS) model, enabling competitive markets for ordering rights without centralizing MEV capture. These experiments suggest that shared sequencers could create fairer MEV markets by standardizing access and reducing reliance on private relays.

However, MEV mitigation remains challenging. Even with auctions, there is no guarantee that all forms of value extraction can be neutralized. Cross-rollup composability expands the surface area for sophisticated MEV strategies, and ongoing research is focused on cryptographic techniques such as threshold encryption and delay functions to minimize exploitability.

Governance and Cross-Domain Coordination

Shared sequencer networks introduce governance complexities absent in single-rollup architectures. Decisions about validator admission, fee distribution, and protocol upgrades affect all connected rollups simultaneously. This creates a tension between network‑wide coordination and rollup sovereignty. If a shared sequencer enacts a change that benefits some rollups but disadvantages others, there is no straightforward resolution mechanism.

Efforts are underway to design modular governance frameworks where rollups retain veto rights or can exit the network without disrupting service. Astria’s validator governance model, for example, allows connected rollups to influence network parameters via multi‑party coordination while preserving their independent execution environments. The challenge lies in scaling this model to dozens of rollups without introducing gridlock or governance fatigue.

Scalability and Economic Considerations

While shared sequencers promise economies of scale, they also concentrate value. Coordinating ordering for multiple high‑value rollups makes the sequencer network an attractive target for attacks, including censorship, bribery, and denial‑of‑service. Securing the network requires substantial economic stake and robust slashing mechanisms. Projects like Radius have experimented with leveraging restaked assets from platforms like EigenLayer to bootstrap security, but this approach introduces new dependencies and risks related to correlated slashing events.

Scalability also presents a technical hurdle. As the number of participating rollups increases, so does the volume of transactions the sequencer must handle. Ensuring low latency while maintaining fair ordering across many chains is nontrivial. Solutions under exploration include sharding the sequencer network or introducing tiered sequencing layers, though these approaches risk reintroducing fragmentation.

Limitations and Open Risks

Despite significant progress, shared sequencer networks remain in early stages. Current systems primarily support atomic inclusion rather than full execution, limiting certain high‑value use cases like composable derivatives or instant multi‑rollup liquidations. Latency improvements, while substantial compared to bridges, still fall short of monolithic chains’ synchronous composability.

Regulatory uncertainty is another factor. As shared sequencers coordinate activity across multiple chains, they may become focal points for compliance requirements or legal liability, particularly in jurisdictions that classify transaction ordering as a regulated function. The concentration of ordering power, even if decentralized, could invite scrutiny from financial regulators seeking to prevent collusion or manipulation.

Finally, user adoption depends on developer tooling and education. Building applications that safely leverage atomic inclusion requires understanding subtle failure modes and designing fallback mechanisms. Without mature SDKs, standardized APIs, and clear documentation, widespread adoption may lag behind the technical capabilities of these networks.