Shared Sequencer Networks Explained

This module examines what shared sequencer networks are, why they have emerged as a key infrastructure layer for rollups, and how they differ from individual sequencer setups. It explores the architecture, design goals, and current implementations, including updates from projects like Astria, Espresso Systems, and Radius.

Concept of Shared Sequencers

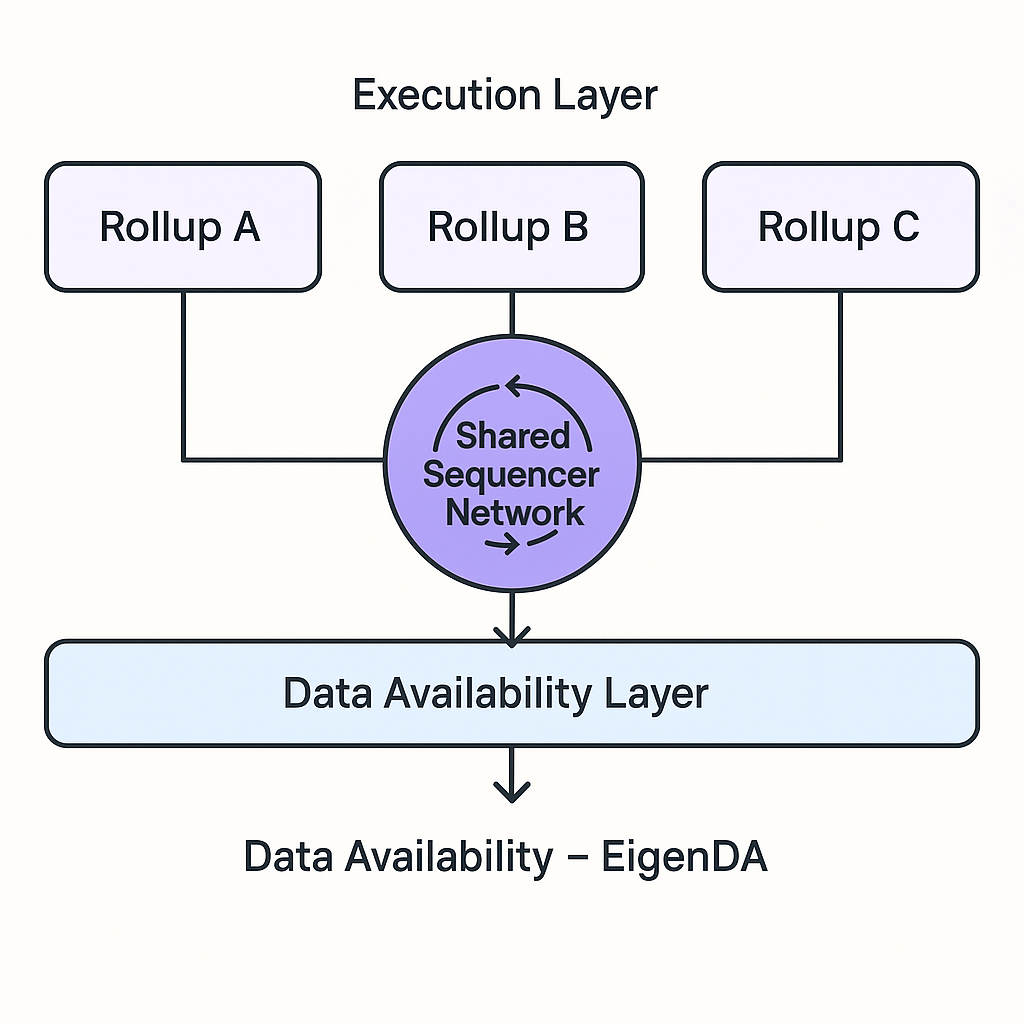

Shared sequencer networks provide a unified ordering layer that multiple rollups can connect to. Instead of every rollup maintaining its own sequencer, these networks function as a common service, similar to how data availability layers like Celestia or EigenDA serve multiple chains. A shared sequencer aggregates transactions from different rollups, orders them in a single consensus mechanism, and publishes the ordering to all participating rollups.

This approach addresses the fragmentation of the rollup ecosystem. Each rollup today often operates in isolation, with its own transaction ordering and finality process. This isolation makes cross‑rollup interactions slow and complex because each rollup’s block timeline is independent. Shared sequencers unify these timelines by providing a synchronized ordering service, which allows for coordinated inclusion of transactions targeting multiple rollups.

The result is a system where rollups can remain sovereign in execution but cooperate on ordering. This design minimizes friction for developers building applications that span multiple rollups and enhances the user experience by enabling near‑synchronous cross‑rollup operations.

Why Shared Sequencers Are Emerging

The demand for shared sequencers is driven by several structural changes in the modular blockchain ecosystem. The first is the rapid increase in the number of rollups, particularly on Ethereum and modular ecosystems like Celestia and Cosmos. As of 2025, more than 50 optimistic and zk‑rollups are live or in development, many targeting specific use cases such as gaming, DeFi, or payments. Without coordination, this proliferation risks creating a “multi‑rollup silos” problem, where each rollup operates as an isolated island with limited composability.

Second, decentralized applications increasingly span multiple rollups. Users may lock assets on one rollup, mint derivatives on another, and perform arbitrage across several others. Without synchronized ordering, these actions rely on asynchronous bridges, introducing latency and risk. Shared sequencers reduce this friction by allowing developers to create workflows that assume near‑simultaneous inclusion across chains.

Finally, shared sequencers align with the trend toward modularity in blockchain design. As execution, consensus, and data availability are increasingly separated, a standalone ordering layer fits naturally into this stack. Just as modular data layers allow multiple rollups to share storage, shared sequencers allow them to share ordering without sacrificing their individual state machines.

Architectural Design and Consensus Models

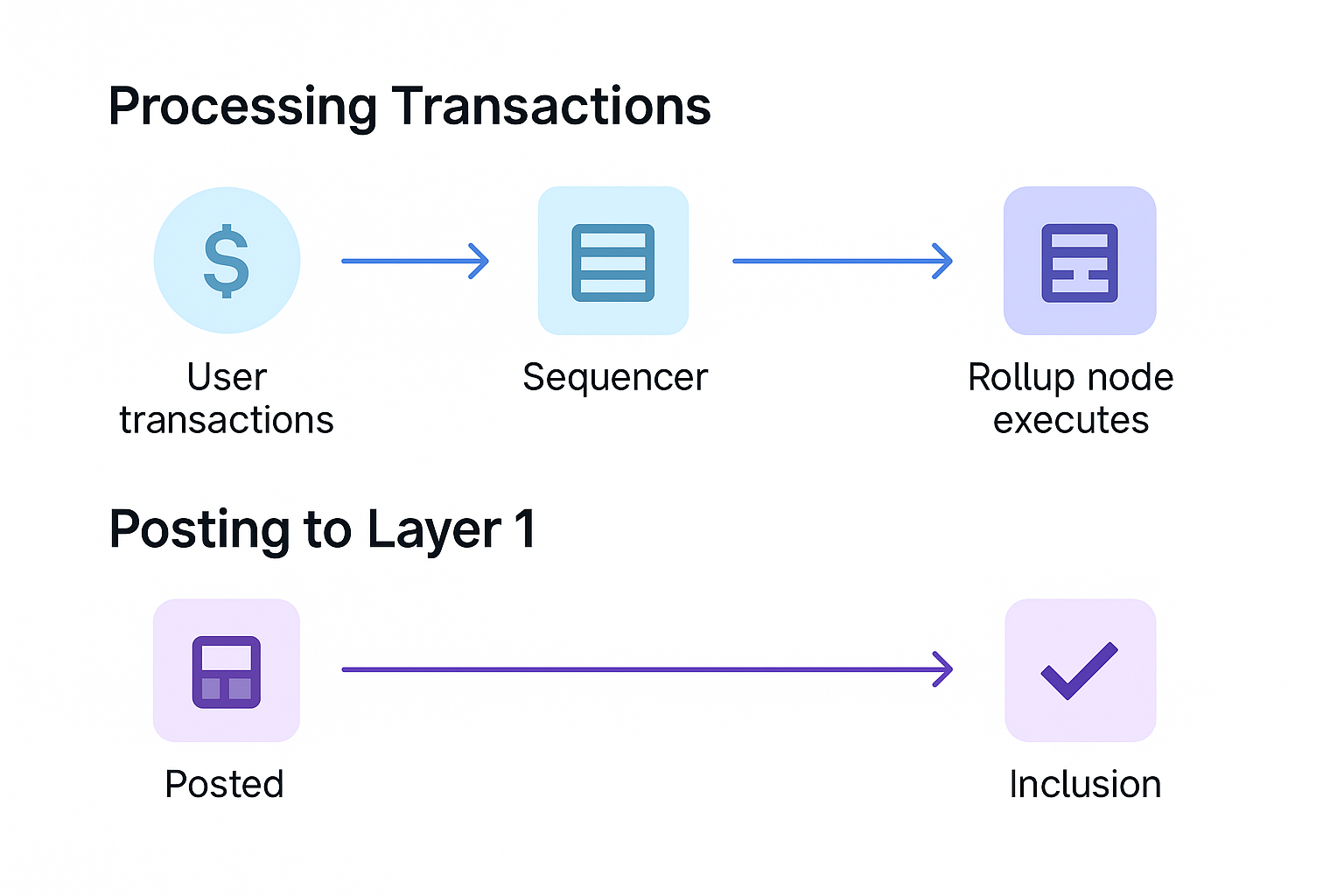

The architecture of a shared sequencer network typically involves a decentralized validator set that runs consensus independently of any specific rollup. Rollups connect to this network via lightweight clients or relayers. When a user submits a transaction, it is forwarded to the shared sequencer, which batches it alongside transactions from other rollups and orders them into blocks.

Consensus is usually Byzantine fault tolerant, with networks like Espresso and Radius adopting variants of HotStuff or Tendermint to achieve low latency and strong finality. Some designs integrate proof‑of‑stake security directly, while others bootstrap security from external systems such as Ethereum validators. For example, Astria uses Celestia for data availability but maintains its own validator set for sequencing.

A critical architectural decision is whether the sequencer performs only ordering (lazy sequencing) or also executes transactions (active sequencing). Lazy sequencing scales better across many rollups but only guarantees atomic inclusion, not atomic execution. Active sequencing, where the sequencer maintains state for each rollup, could provide full atomicity but faces severe scalability challenges.

Key Properties and Advantages

Shared sequencer networks aim to provide several guarantees that are difficult for individual rollup sequencers to achieve. The first is censorship resistance: by distributing ordering across many validators, the network reduces the ability of any single operator to exclude transactions. This is particularly relevant for cross‑rollup actions, where censorship by one rollup’s sequencer could break composability.

The second property is liveness. In a shared network, if one sequencer node fails or misbehaves, others can continue processing transactions. This redundancy avoids downtime that might occur with single‑sequencer architectures. It also facilitates upgrades and maintenance without halting the entire system.

Economies of scale represent another advantage. Instead of every rollup bootstrapping its own validator set, a single shared network can amortize the cost of decentralization across multiple chains. This reduces capital requirements for new rollups and accelerates time to market. It also creates a common interface for developers, simplifying tooling and reducing integration complexity.

Current Implementations and Ecosystem Updates

Several projects are actively building shared sequencer networks, each with distinct design choices. Astria launched its mainnet in early 2025, positioning itself as a Cosmos‑based shared sequencer for rollups that use Celestia for data availability. Astria emphasizes lazy sequencing, meaning it does not maintain rollup state but ensures consistent ordering across participating chains. This design allows Astria to scale horizontally as new rollups join without significant overhead.

Espresso Systems, initially focused on privacy‑preserving rollups, has expanded its scope to a general‑purpose shared sequencer. In 2024, Espresso integrated with Polygon’s AggLayer to demonstrate cross‑rollup ordering for zk‑rollups. Its architecture uses HotStuff‑based consensus and supports modular integration with multiple data availability layers. The project has been testing sequencing auctions to address MEV (maximal extractable value) concerns, allowing builders to bid for transaction ordering rights in a decentralized marketplace.

Radius, another notable entrant, is experimenting with proof‑of‑stake sequencing combined with data availability proofs. In late 2024, Radius ran a testnet supporting concurrent ordering for multiple application‑specific rollups, demonstrating sub‑second finality for cross‑rollup transactions. Its focus on composable financial primitives positions it as an infrastructure layer for DeFi‑heavy ecosystems.

Other initiatives, such as NodeKit and Rome Protocol, are exploring similar concepts. NodeKit targets high‑throughput gaming rollups, while Rome aims to bridge Ethereum rollups with modular ecosystems like Celestia and EigenLayer.

Limitations and Open Questions

Despite their promise, shared sequencer networks face unresolved challenges. One is the question of economic security: how much stake or external validation is required to secure ordering across many high‑value rollups? Unlike individual sequencers, shared networks aggregate more value and may become prime targets for attacks. Designing credible slashing conditions and incentivizing honest behavior across diverse participants remains complex.

Another challenge is latency. While shared sequencers aim to provide low‑latency ordering, coordinating multiple rollups inevitably adds communication overhead. Ensuring that this overhead does not degrade user experience relative to centralized sequencers is an active area of optimization.

Governance is also unsettled. Decisions about validator admission, fee distribution, and protocol upgrades affect all participating rollups, raising questions about coordination and representation. A governance model that balances network‑wide security with rollup sovereignty is critical for long‑term adoption.

Finally, the debate over atomic execution versus atomic inclusion continues. Some argue that inclusion guarantees are sufficient for most cross‑rollup use cases, while others see full execution atomicity as essential for financial composability. Achieving atomic execution without forcing every sequencer node to maintain all rollup states remains an open research problem.