Atomic Composability in Multi-Rollup Context

This module focuses on atomic composability as a concept and explains how it applies to multi-rollup environments supported by shared sequencer networks. It distinguishes between atomic inclusion and atomic execution, examines their technical implications, and evaluates current solutions and challenges in achieving seamless composability across rollups.

Defining Atomic Composability

Atomic composability refers to the ability for multiple operations across distinct systems to be executed as a single, indivisible unit—either all succeed together or none are executed at all. In traditional monolithic blockchains, this property is inherent: applications built on the same chain can compose freely because transactions are executed within a single global state. A decentralized exchange can interact with a lending protocol in one transaction without risk of partial completion.

In a multi-rollup environment, this property is broken. Each rollup maintains its own state and execution timeline, meaning a transaction on one rollup may finalize independently of another. Without a coordinating layer, a cross-rollup action such as locking an asset on Rollup A and minting a derivative on Rollup B cannot guarantee atomicity. This creates risks of partial failure, double exposure, or stranded funds. Atomic composability mechanisms aim to restore this guarantee in modular ecosystems.

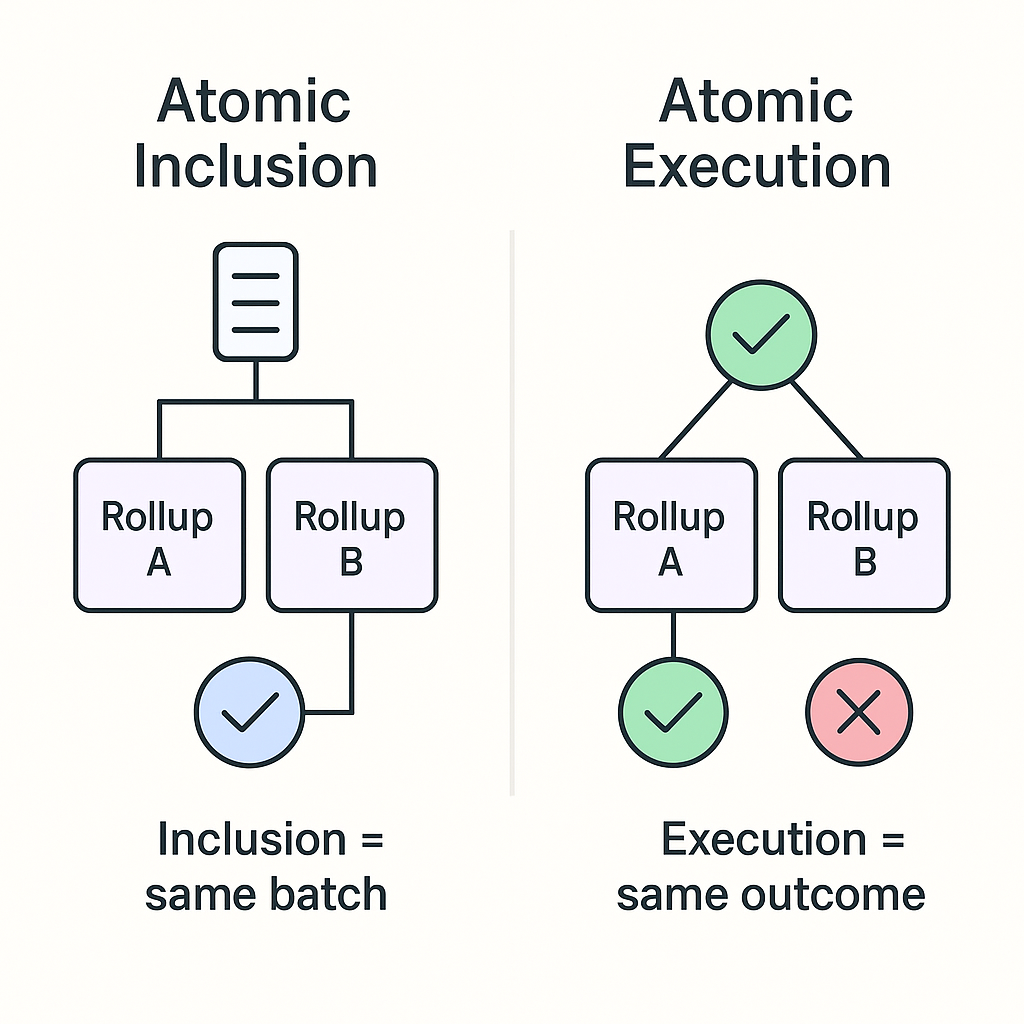

Atomic Inclusion Versus Atomic Execution

Two distinct forms of atomicity are relevant in shared sequencer designs: atomic inclusion and atomic execution. Atomic inclusion ensures that transactions targeting multiple rollups are ordered together in the same batch or block. For example, a lock operation on Rollup A and a mint operation on Rollup B would both be included or excluded together, preventing scenarios where one is included and the other is not. This property addresses ordering but not outcome.

Atomic execution goes further by ensuring that all operations either succeed or fail collectively upon execution. Achieving this requires awareness of each rollup’s state during ordering, allowing the sequencer or builder to guarantee that dependent transactions will not revert. In practice, this is significantly more complex. Rollups may have different virtual machines, proof systems, and execution semantics, making synchronized state validation across multiple environments costly and technically challenging.

Most shared sequencer networks today provide atomic inclusion but not atomic execution. Astria, for instance, batches cross-rollup transactions together but does not track state transitions, leaving outcome guarantees to rollup-level logic. Research initiatives by projects like Espresso and Ethereum’s PBS (Proposer-Builder Separation) ecosystem are exploring ways to incorporate state proofs into sequencing, but these approaches are still experimental.

Why Atomic Composability Matters

Composability underpins much of decentralized finance and Web3 application design. Yield strategies, flash loans, and cross-protocol arbitrage all rely on the ability to chain multiple actions without exposure to partial failure. Without composability, users must rely on bridges, custodial intermediaries, or off-chain coordination, introducing latency and security risks.

In a fragmented rollup landscape, lack of composability threatens the network effects that originally made Ethereum’s DeFi ecosystem successful. Shared sequencer networks address part of this problem by offering synchronized ordering, but without full atomic execution, certain advanced strategies remain infeasible. This trade-off is central to ongoing debates about whether rollups should remain sovereign or converge toward shared state layers.

Current Approaches to Achieving Atomicity

Current implementations of atomic composability are layered solutions rather than monolithic fixes. One approach is optimistic cross-rollup bridging, where transactions are batched atomically but rely on rollup-specific fraud or validity proofs to finalize. Another approach is using intent-based architectures, where solvers or builders coordinate multi-chain actions off-chain and submit them as aggregated bundles to shared sequencers. These solutions reduce complexity by deferring some logic to off-chain coordination while relying on shared sequencing for ordering guarantees.

Research into “superbuilders” extends this concept further. A superbuilder would maintain partial or full state awareness of multiple rollups, enabling true atomic execution by constructing cross-rollup bundles that are state-valid upon inclusion. This model is conceptually similar to cross-domain MEV searchers and is being explored in the context of Ethereum’s rollup-centric roadmap.

Projects like Espresso have piloted shared sequencing auctions where builders compete to include cross-rollup bundles with composability guarantees. Early experiments show promise in reducing latency and slippage for arbitrage strategies, though challenges remain in preventing reorgs and handling state divergence between rollups.

Challenges in Implementing Atomic Execution

Achieving atomic execution across rollups faces fundamental challenges. The first is heterogeneity: rollups may use different proof systems (zk-SNARKs, STARKs, optimistic fraud proofs) and virtual machines (EVM, WASM, custom VMs), making synchronized state verification computationally expensive. Any sequencer attempting to validate all states risks becoming a bottleneck.

The second challenge is latency. Verifying multiple rollup states in real time could introduce delays that undermine user experience and negate the low-latency advantage of centralized sequencers. Hybrid models, where only critical bundles are state-validated, may offer a compromise but add complexity to system design.

Economic security is another concern. Shared sequencer networks become high-value targets, especially when coordinating atomic execution for financial applications. Incentive structures must align validator interests with correct behavior, and slashing conditions must be carefully designed to penalize equivocation or censorship without discouraging honest participation.

Implications for Application Developers

For developers building cross-rollup applications, understanding the distinction between inclusion and execution is critical. Applications that only require synchronized ordering—such as batch auctions or cross-chain governance—can function on today’s shared sequencer networks. However, applications requiring guaranteed execution across multiple rollups, such as complex DeFi strategies or composable derivatives, must design additional safeguards, such as rollback mechanisms, escrow contracts, or delayed settlement.

The emergence of shared sequencer APIs and intent-based protocols may abstract much of this complexity over time. Developers could specify desired outcomes (e.g., “swap on Rollup A, lend on Rollup B if rates exceed X”) and rely on solvers and sequencers to coordinate execution atomically. This model mirrors trends in generalized intents explored by projects like Anoma and SUAVE, which aim to unify liquidity and composability across fragmented chains.