MoonRocketTeam

In the fluctuation of the crypto assets market, the most terrifying thing is not the sudden drop in asset value, but the inability to accurately assess the extent of one's losses. This uncertainty is often more unsettling than the actual losses.

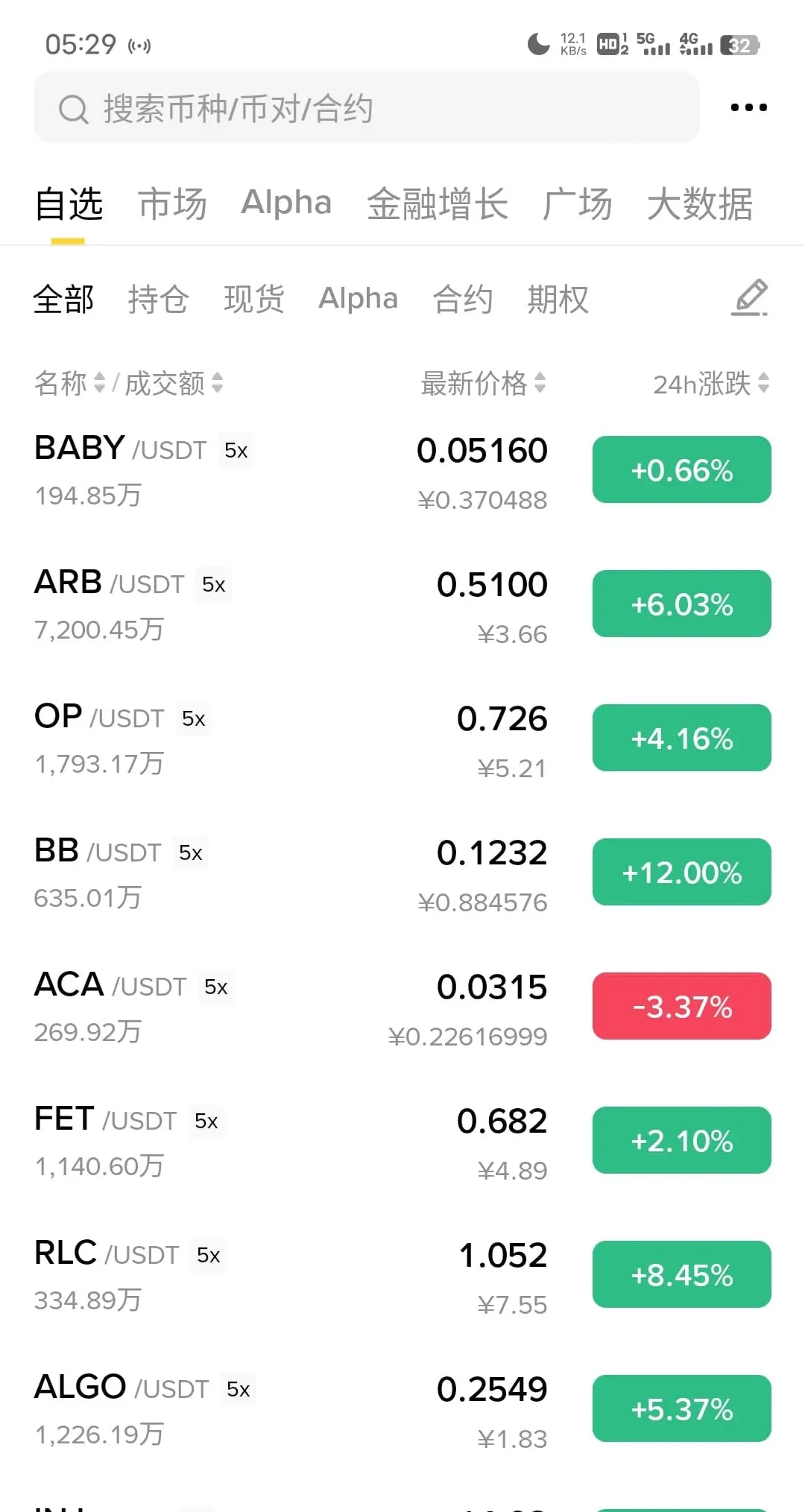

Recently, an emerging blockchain analysis tool has attracted the attention of investors. This tool is like a financial microscope tailored for the world of digital assets, capable of deeply analyzing every transaction and asset in users' wallets. Through this detailed analysis, investors can clearly see the true state of their investment portfolio.

Sur

View OriginalRecently, an emerging blockchain analysis tool has attracted the attention of investors. This tool is like a financial microscope tailored for the world of digital assets, capable of deeply analyzing every transaction and asset in users' wallets. Through this detailed analysis, investors can clearly see the true state of their investment portfolio.

Sur