Another Crypto Black Swan? A Full Breakdown of Ethereum’s Crash Triggers

Ethereum’s Recent Price Trends

As of March 29, Ethereum closed at $1,842,marking a monthly decline of 13.12% but failed to sustain upward momentum, quickly weakening.

Since mid-March, despite several attempted rebounds, ETH encountered strong resistance in the $2,000–$2,100 range, reflecting weak bullish sentiment. After March 22, ETH’s price broke through key support levels consecutively, eventually retreating to its current low range.

ETH price movement from March 1 to March 29 (Chart Source: https://coinmarketcap.com/currencies/ethereum/)

Technical indicators reveal concerning signals including 24-hour trading volume declining 25% week-over-week to approximately $1.19 billion USD, market capitalization contracting to $222.3 billion USD, and price action showing characteristics of a breakdown from consolidation into a bearish continuation pattern.

The immediate outlook suggests potential tests of the $1,700-$1,800 USD support zone unless ETH can reclaim $2,000 USD convincingly. Market participants should monitor on-chain liquidity metrics, leverage liquidation clusters, and potential positive catalysts that could change market sentiment.

Why Ethereum is Falling

Recent Coinbase account hacks involved attackers using ThorChain and Chainflip to move stolen assets from Bitcoin to Ethereum, converting them to stablecoins for rapid selling. Through Ethereum alone, 14,064 ETH (approximately $27.5 million USD) were dumped. Analysis suggests this may be part of a larger operation by North Korea hacking group Lazarus, totaling over $46 million USD in losses.

Lazarus Group’s crypto asset movements (Image source:https://cn.cointelegraph.com/news/lazarus-group-deposits)

On the other hand, recent data from the U.S. Bureau of Economic Analysis revealed a 2.8% year-over-year increase in February’s core Personal Consumption Expenditures price index. This elevated inflation reading has intensified concerns about sustained higher interest rates, creating additional headwinds for risk-sensitive assets across financial markets.

Overall, the cryptocurrency sector faces compounding pressures from both macroeconomic conditions and security concerns. This dual challenge has triggered broad market declines, with the total digital asset market capitalization retreating from $3.3 trillion at its peak to approximately $2.6 trillion currently.

How Much Further Can Ethereum Fall?

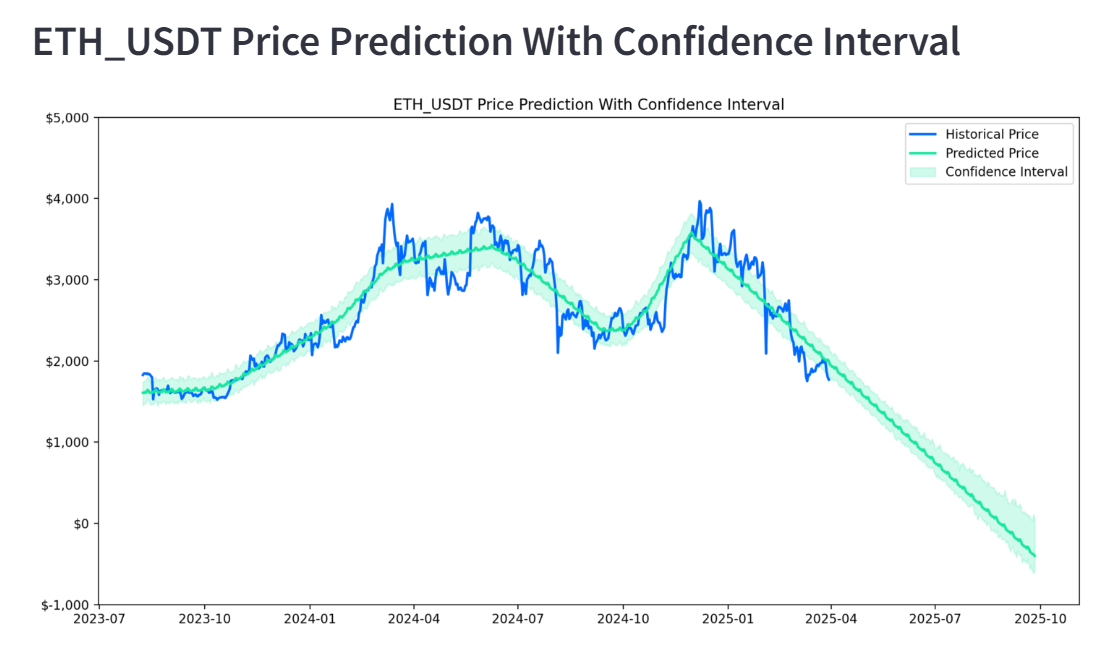

The chart reveals that since reaching its cyclical peak in early 2025, ETH has entered a clearly defined medium-term downward channel. Current predictive models indicate the price benchmark has gradually declined from its highs, with the downward trend accelerating significantly during Q2 2025. Technical analysis further confirms weakening market dynamics, as ETH’s multiple attempted upward breakouts over recent months have all failed, reflecting diminished capital momentum and eroding investor confidence. The current price action aligns precisely with model projections, suggesting the market is undergoing a comprehensive “price reassessment” phase in response to negative catalysts and macroeconomic uncertainties.

Looking ahead, ETH’s price is expected to continue its downward trajectory in coming months. Barring any systemic capital inflows, our models project ETH may decline to the $1,000-$1,200 range between June and September 2025, potentially establishing the cycle’s bottom range. The lower confidence band extends toward approximately $800, indicating potential breach of psychological support levels under extreme market sentiment or black swan events.

Notably, the confidence interval maintains measurable volatility elasticity, implying potential stabilization should market sentiment improve. This correction appears more characteristic of a mid-cycle adjustment within a broader bull market rather than a structural collapse. The key variables determining future price action will be macroeconomic conditions and on-chain fundamental performance during Q2-Q3 2025.

Ethereum Price Outlook: 2025 Trend Forecast(Image source:Crypto Price Prediction · Streamlit)

Investment Risk Warning

In the current market environment, Ethereum is facing multiple overlapping risk factors, and investors are advised to closely monitor its developments. From a price perspective, ETH has recently experienced significant volatility, and market stability has yet to be established. At the same time, emerging high-performance blockchains like Solana are rapidly attracting users and liquidity through meme assets and high-frequency trading activity, posing a challenge to Ethereum’s market dominance.

Recently, large on-chain wallets (whale addresses) have exhibited portfolio adjustments and risk-averse behavior amid the broader downturn in the crypto market. Some funds are accelerating their withdrawal from DeFi or staking contracts, further dampening market confidence. More critically, regulatory uncertainties in the U.S. and other major economies could impose periodic shocks on ETH’s trading activity, platform expansion, and liquidity structure.

Additionally, while Ethereum staking has become a key component of its on-chain ecosystem, investors should remain cautious about liquidity constraints and smart contract risks when participating in staking, especially given ongoing price volatility, which may amplify risk exposure. Investors are advised to assess market dynamics in line with their risk tolerance, avoid excessive leverage, and monitor on-chain signals as a reference for mid-to-short-term trends.

Conclusion

At present, Ethereum is navigating a critical phase marked by macroeconomic pressures and on-chain security risks. Although short-term technical indicators have yet to signal a clear reversal, historical cycles and on-chain activity suggest that this correction may represent a mid-cycle pullback within a bull market rather than a systemic collapse. Future performance will hinge on the trajectory of macroeconomic inflation, shifts in regulatory policies, and Ethereum’s own technological advancements and scalability. For investors, maintaining rational judgment, exercising caution in positioning, and controlling leverage remain essential strategies for weathering market cycles, particularly amid heightened volatility and unresolved sentiment risks.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025