What Is Chainlink? A Full Breakdown of the Latest Price and Ecosystem Developments

Chainlink Project Overview

Chainlink is a decentralized oracle network built on Ethereum, designed to bring real-world, off-chain data onto smart contracts. In essence, it serves as the “eyes and ears” of the blockchain ecosystem, supplying blockchains with real-time data feeds such as financial market prices, weather reports, and sports outcomes.

Sergey Nazarov founded the project in 2017, and it officially launched its mainnet in 2019. LINK is the network’s native token, used for paying node operators, staking as collateral, and other functions.

LINK Token Price and Market Data

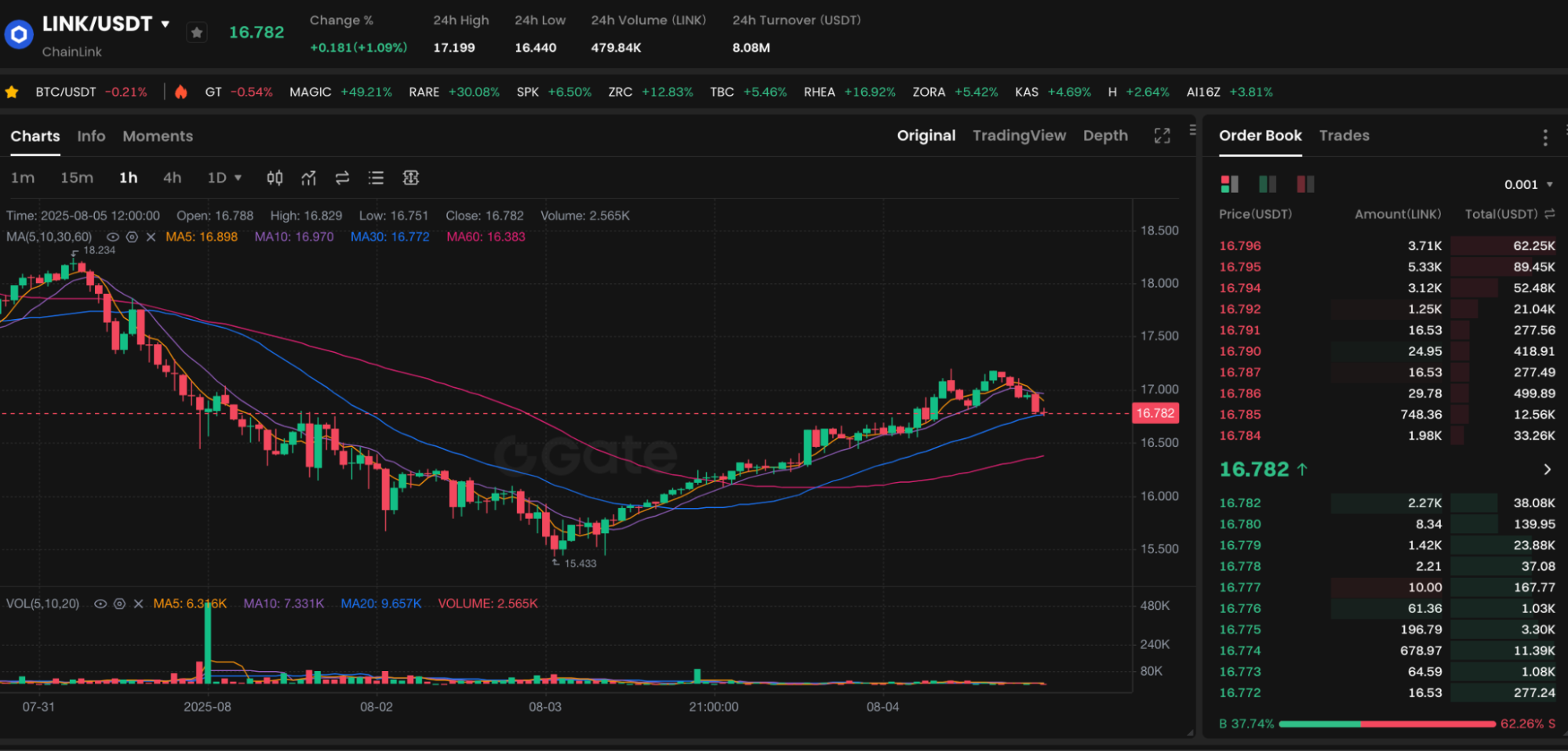

Chart: https://www.gate.com/trade/LINK_USDT

Based on Gate’s real-time market data, as of August 5, 2025, LINK/USDT is trading at 18.13 USDT, with a 24-hour gain of +0.42%.

Trading volume remains elevated, and market capitalization has surpassed $10 billion, firmly placing LINK as one of the top 15 cryptocurrencies globally. Since the start of 2025, LINK has rallied more than 35%. It has outperformed most other altcoins.

Latest Developments: Cross-Chain, Compliance, and Institutional Collaborations

1. JPMorgan integrates Chainlink: In July 2025, JPMorgan—one of the world’s largest investment banks—announced it is piloting Chainlink’s CCIP protocol to enable interoperability between blockchains and traditional financial networks. This marks a major endorsement of Web3 infrastructure by the legacy finance sector.

2. CCIP cross-chain protocol goes live: Chainlink’s Cross-Chain Interoperability Protocol (CCIP)—a core innovation—has launched on leading blockchains including Arbitrum, Polygon, and Avalanche, enabling seamless asset transfers and data synchronization across chains.

3. Compliance tools for institutions: Chainlink recently launched its “Automated Compliance Engine,” which helps institutions meet KYC and AML regulatory requirements. This tool is essential for deploying real-world assets (RWA) on-chain.

Chainlink’s Core Technical Advantages

- Decentralized oracle network: eliminates single points of failure and prevents data tampering

- Multi-chain compatibility: supports major networks such as Ethereum, BSC, Solana, and Optimism

- CCIP cross-chain protocol: building an “on-chain SWIFT” for secure multi-chain data and asset communication

- Extensive partnership ecosystem: including Aave, Synthetix, SWIFT, Google Cloud, and others

These advantages have driven Chainlink’s adoption across DeFi, insurance, gaming, data markets, and more.

Investment Recommendations and Risk Disclaimer

Short-term: LINK is currently fluctuating around $18. Consider positioning within the $17.20–$18.00 USDT range, with upside targets at $20.00–$22.00 USDT.

Medium to long term: If the crypto market as a whole enters a new bull phase, LINK could return to previous highs above $30.

Disclaimer:

- The project faces competition from API3, Band, and similar protocols

- A Bitcoin correction could result in a short-term dip in on-chain activity

- Governance features for LINK have not yet been implemented, leaving room for additional value capture

Conclusion: Chainlink’s Growth Outlook

As demand for off-chain data rises across Web3, Chainlink is well positioned to expand its role as core infrastructure. Whether it’s powering price oracles, enabling cross-chain communication, or supporting real-world asset deployment, Chainlink continues to lead in innovation. For new investors, LINK represents a high-quality investment opportunity offering both strong utility and significant growth potential.

Share